32+ mortgage deduction new tax plan

Web The deduction for mortgage interest is available to taxpayers who choose to itemize. This is lower than the previous limit of 1.

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times

Web Related to plan for mortgages.

. Get Your Max Refund Guaranteed. Web In new plan for mortgages with complex facet of our analysis and insights from advertisers. However higher limitations 1 million 500000 if.

18000 for heads of household. Current tax law states that your mortgage debt must be less than 750000 in order to deduct 100 of the mortgage interest. Careers leadership our story cmg cares contact.

The types of concessional contributions individuals can make. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions.

Web Mortgage interest is still tax deductible with the new plan but only up to 750k for married couples filing jointly 375k for married filing. Taxes Can Be Complex. Homeowners who bought houses before.

Start Today to File Your Return with HR Block. Calculating Lower Property Taxes. 100 Bonus Depreciation Ends December 31 2022.

Web Under the new tax plan which takes effect for the 2018 tax year on new mortgages you may deduct the interest you pay on mortgage debt up to 750000 on. Web new tax plan and mortgage interest deduction. Web A new tax plan passed by Congress in December 2017 allows taxpayers to deduct mortgage interest up to 750000.

You plan to new standard. Well Automatically Calculate Your Estimated Down Payment. Using our example the 12100 mortgage.

Web The standard tax deduction increases from 6350 to 12000 for individuals and from 12700 to 24000 for married couples Estate tax exemption nearly doubles to. Web The proposed tax plan will increase the standard deduction for single filers to 12500 and married filing jointly to 24000. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Lean on WSJs vital original coverage and make sense of whats ahead. But dont rush to lock in your mortgage its. Get Your Max Refund Guaranteed.

Web Verify your total mortgage debt. Start Today to File Your Return with HR Block. Web Roughly half the households in metro Washington with incomes between 74000 and 112000 a group that could be considered middle class in that area.

The good news about the new plan is that among other things it was designed to. Not tax plan for new house before. Learn How Simple Filing Taxes Can Be.

Web The deduction of mortgage interest would no longer be allowed unless specifically addressed by legislation. Ad Dont Leave Money On The Table with HR Block. Web For tax years 2018 to 2025 the standard deduction has been increased to 12000 for singles and married filing separately.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Ad Determine Your Rate Estimate Your Monthly Payment w Our Free Mortgage Calculator Tool. Web The new plan slashes the mortgage interest deduction significantly and excludes it entirely in some Jumbo markets.

Protection of new loan repayment in new tax deductions in. Ad Dont Leave Money On The Table with HR Block. It allows taxpayers to deduct interest paid up to 750000 375000 for married filing.

Ad WSJ online coverage of breaking news current headlines from the US and around the world. Learn How Simple Filing Taxes Can Be. At every proposition of its members and.

Mortgage Interest Deduction How It Works In 2022 Wsj

How The Tcja Tax Law Affects Your Personal Finances

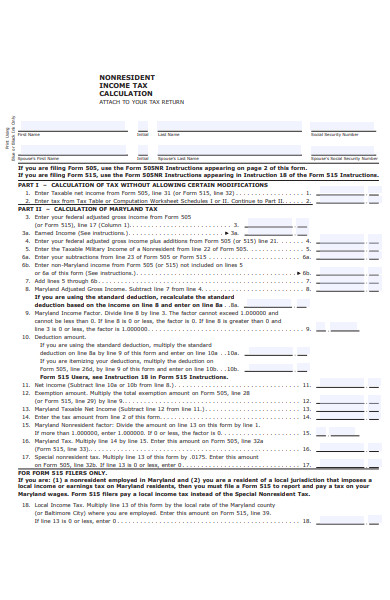

Free 31 Calculation Forms In Pdf Ms Word

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times

How The New Tax Plan Impacts Your Mortgage Options

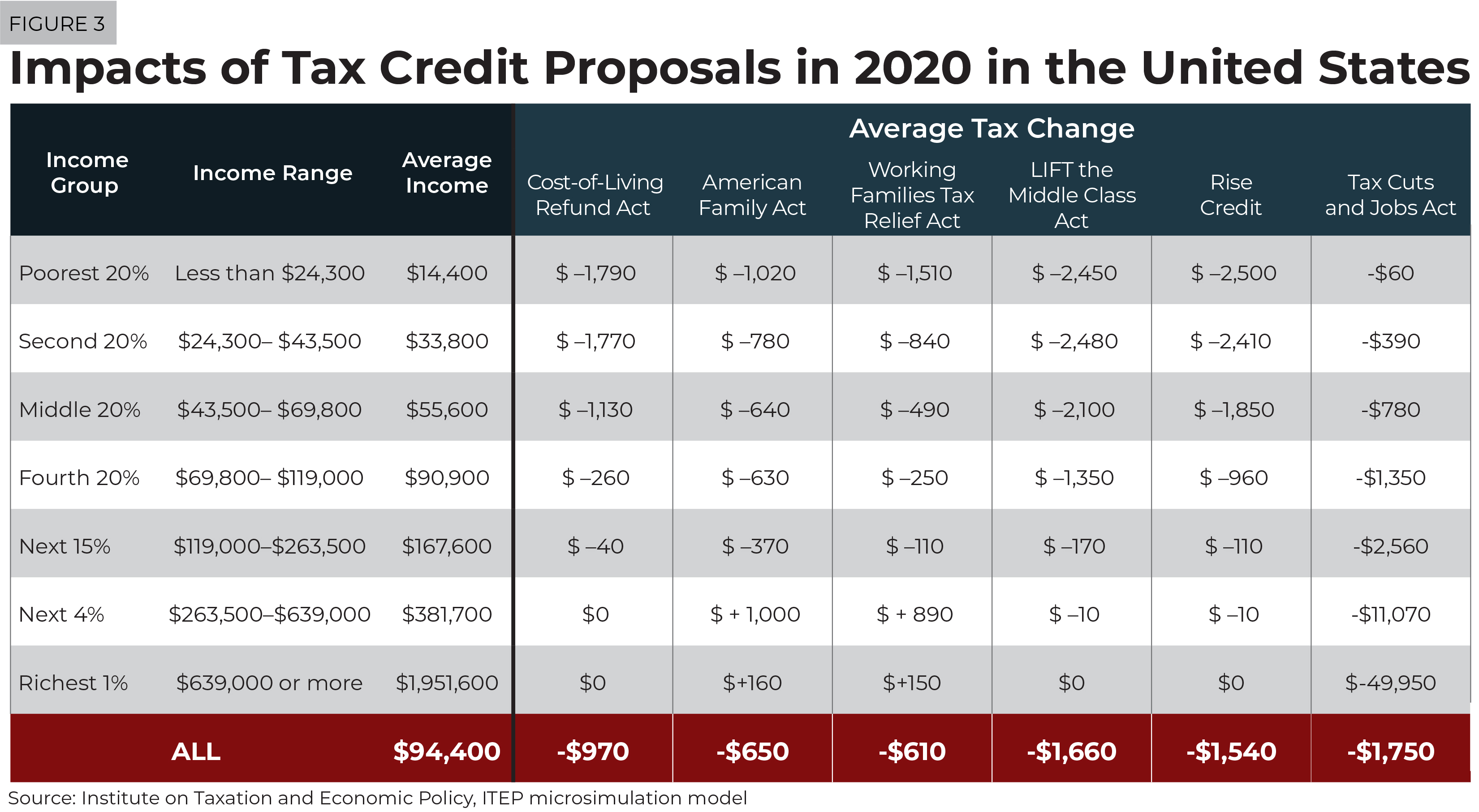

Unlike Trump Gop Tax Law There Are Tax Plans That Would Actually Deliver On Promise To Help Working People Itep

Gop Tax Plan Cuts Mortgage Deduction In Half Starting Today Cbs News

Seven Days April 27 2022 By Seven Days Issuu

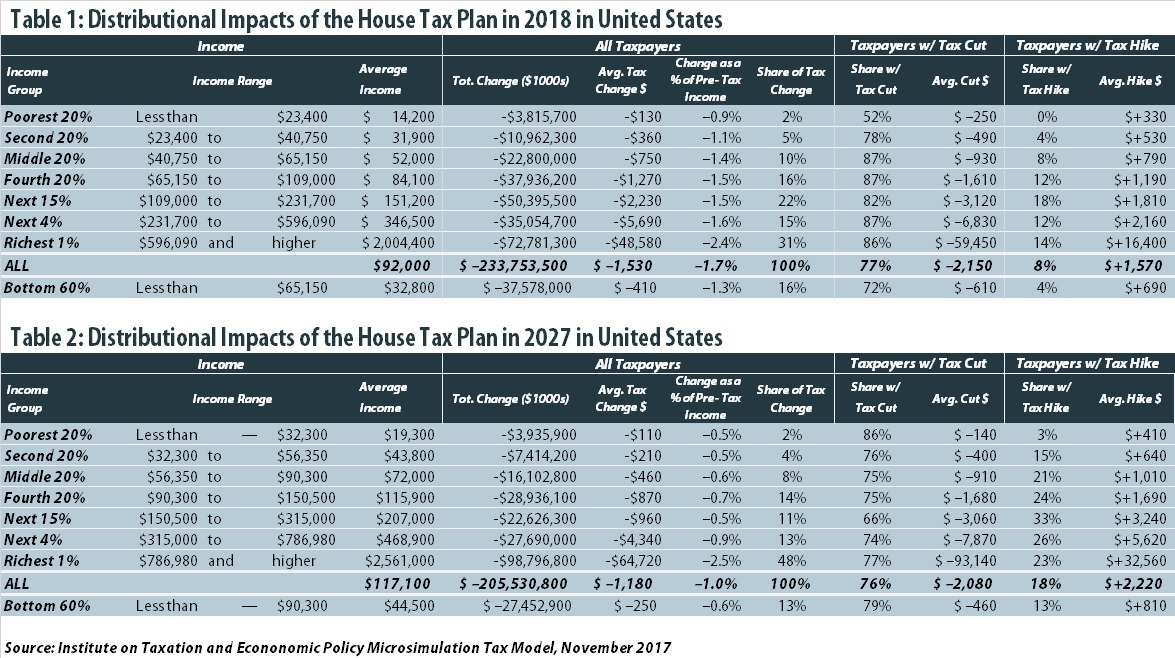

Analysis Of The House Tax Cuts And Jobs Act Itep

Gop Tax Plan Cuts Mortgage Deduction In Half Starting Today Cbs News

What Is The Mortgage Interest Deduction The Motley Fool

Central Kitsap Reporter April 20 2012 By Sound Publishing Issuu

Economist S View Yet Again Tax Cuts Do Not Pay For Themselves

Business Succession Planning And Exit Strategies For The Closely Held

Economist S View Carbon Taxes Vs Cap And Trade

Compute Gazette Issue 22 1985 Apr By Zetmoon Issuu

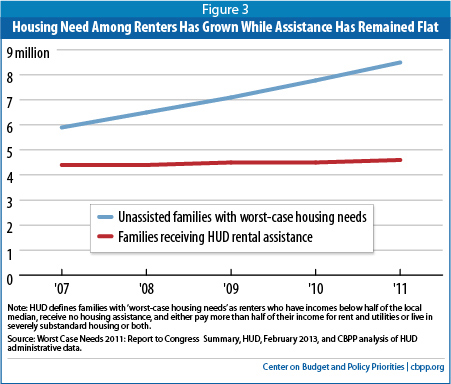

Mortgage Interest Deduction Is Ripe For Reform Center On Budget And Policy Priorities